In the world of finance, keeping track of your financial health is essential. One way to do this is by utilizing financial reports. These reports provide a snapshot of your financial situation, allowing you to make informed decisions about your money.

In this guide, we will explore what financial reports are, why they are important, how to create them, examples of different types of reports, and tips for successful financial reporting.

What are Financial Reports?

Financial reports are documents that provide a detailed overview of an individual or organization’s financial status. These reports typically include information such as income, expenses, assets, liabilities, and net worth. By organizing this data in a clear and concise format, financial reports help individuals and businesses understand their financial position and make informed decisions about budgeting, investing, and saving.

Creating a financial report can be a valuable tool for tracking financial progress, setting financial goals, and identifying areas for improvement. Whether you are looking to manage your personal finances more effectively or track the financial performance of your business, financial reports can provide valuable insights into your financial situation.

Why are Financial Reports Important?

financial reports are important for several reasons. Firstly, they provide a clear overview of your financial situation, allowing you to see where your money is coming from and where it is going. This information can help you make informed decisions about budgeting, saving, and investing.

Additionally, financial reports can help you track your progress towards financial goals. By regularly reviewing your financial reports, you can monitor your financial health and make adjustments as needed to stay on track.

How to Create Financial Reports

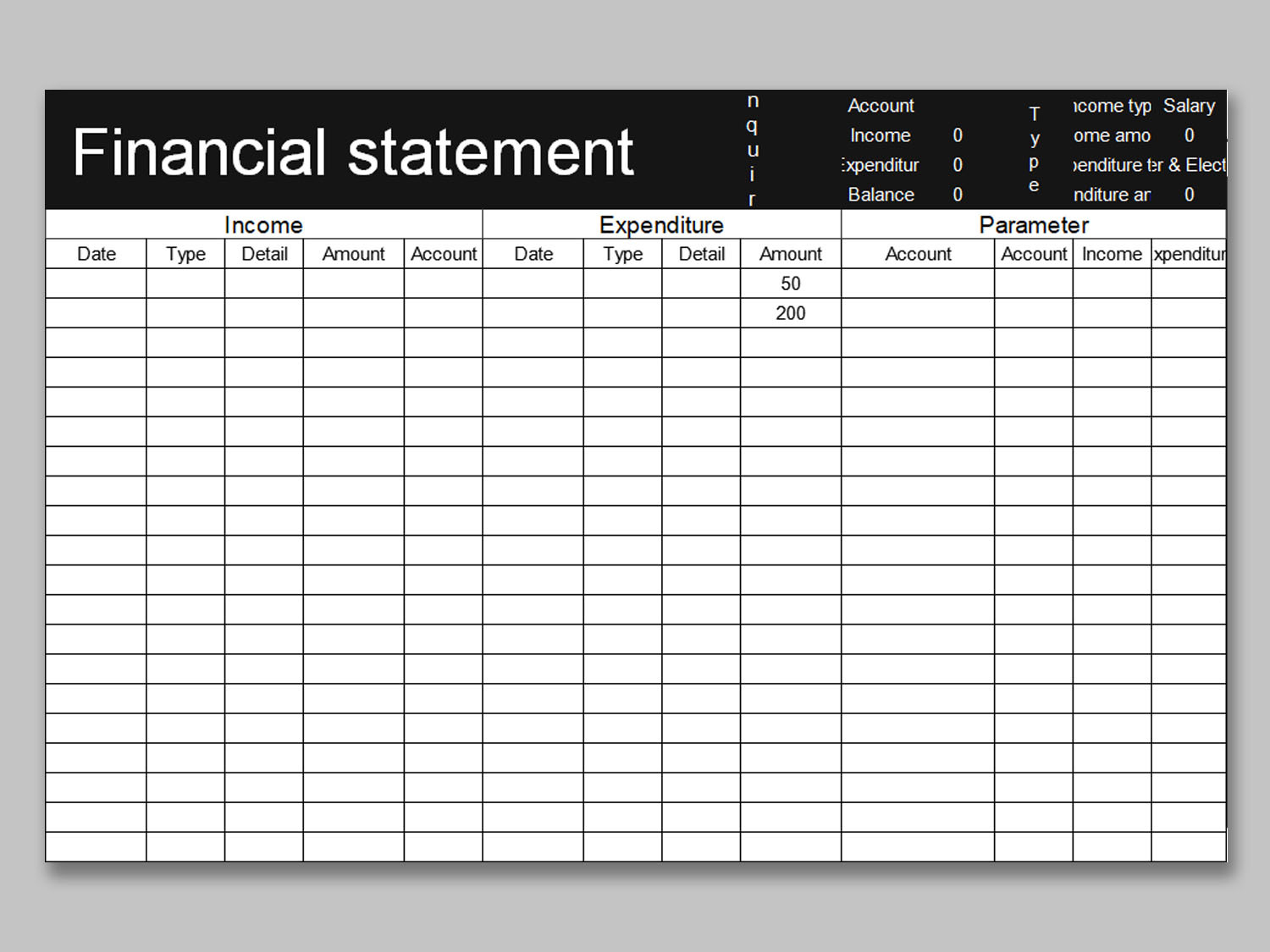

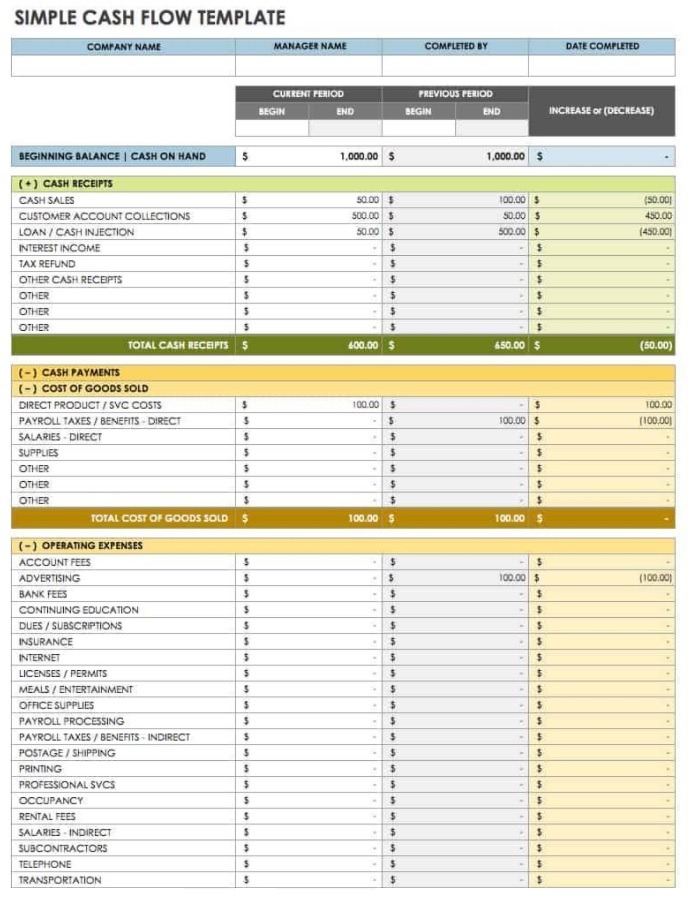

Creating a financial report is a straightforward process that can be done using spreadsheet software such as Microsoft Excel or Google Sheets. To create a basic financial report, follow these steps:

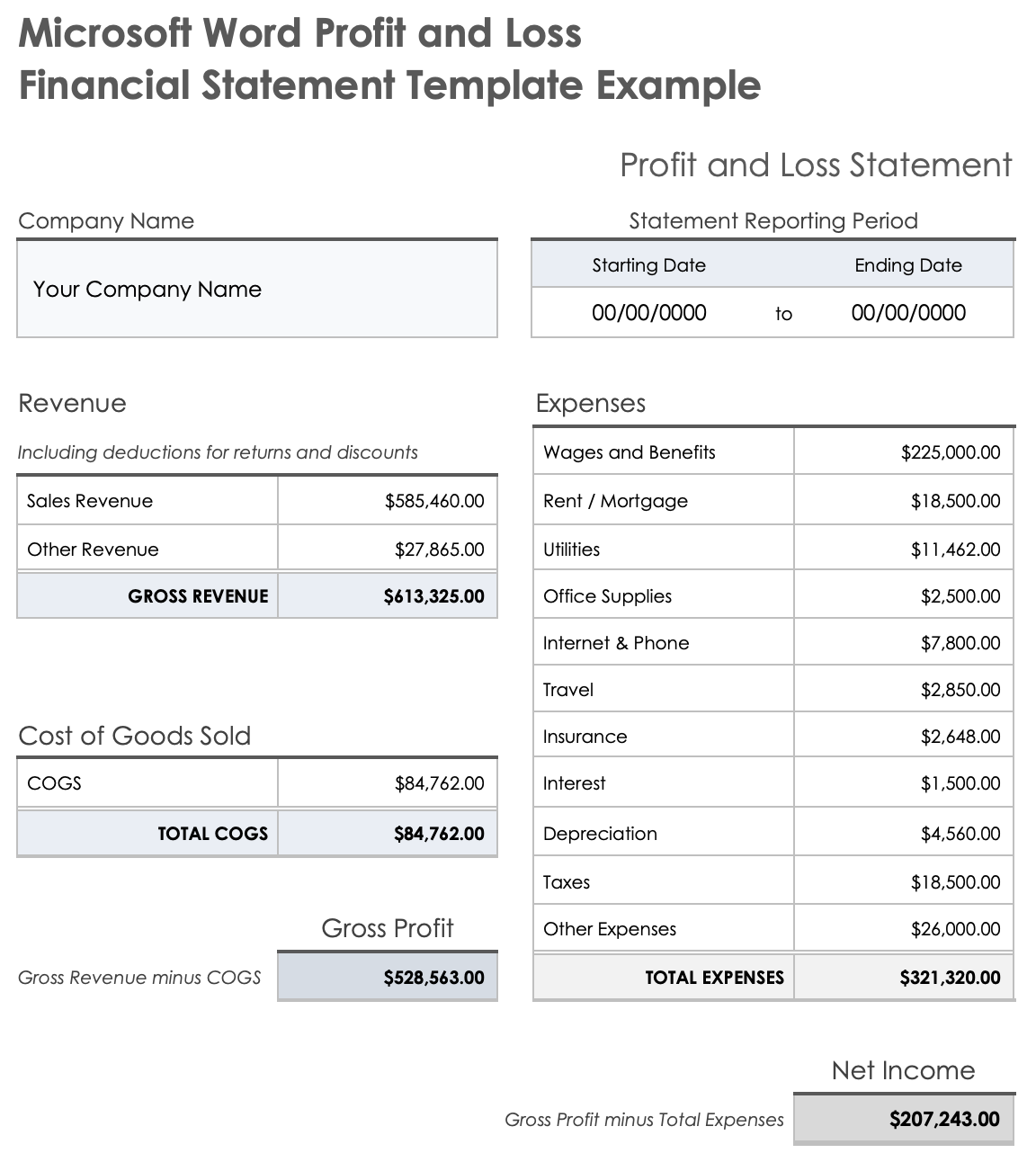

1. Start by listing your sources of income, such as wages, dividends, or rental income.

2. Next, list your expenses, including fixed expenses like rent or mortgage payments, as well as variable expenses like groceries or entertainment.

3. Calculate your total income and total expenses to determine your net income.

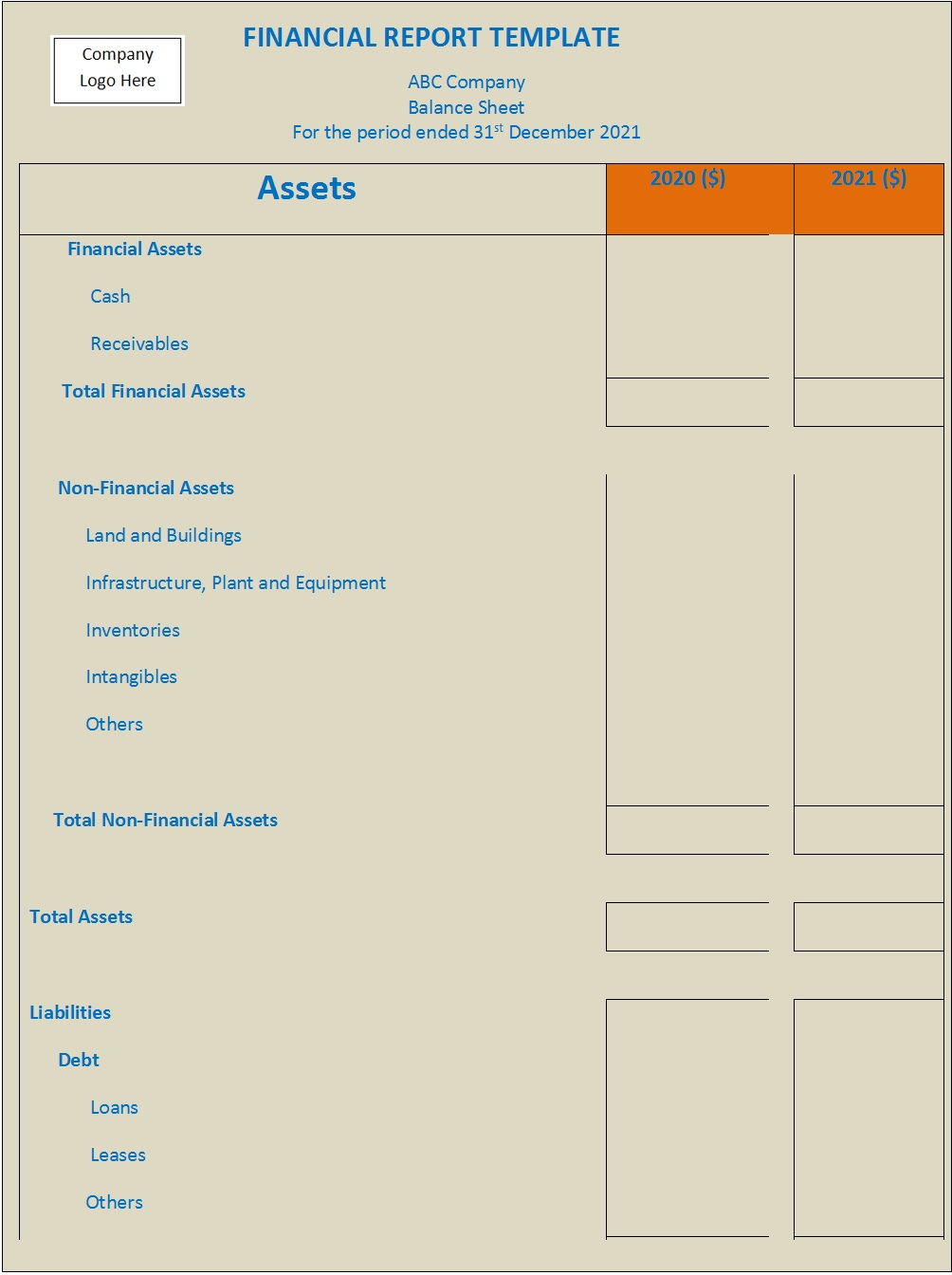

4. List your assets, such as savings accounts, investments, and property.

5. List your liabilities, such as credit card debt, student loans, or mortgage debt.

6. Calculate your net worth by subtracting your liabilities from your assets.

By following these steps, you can create a basic financial report that provides a snapshot of your financial situation.

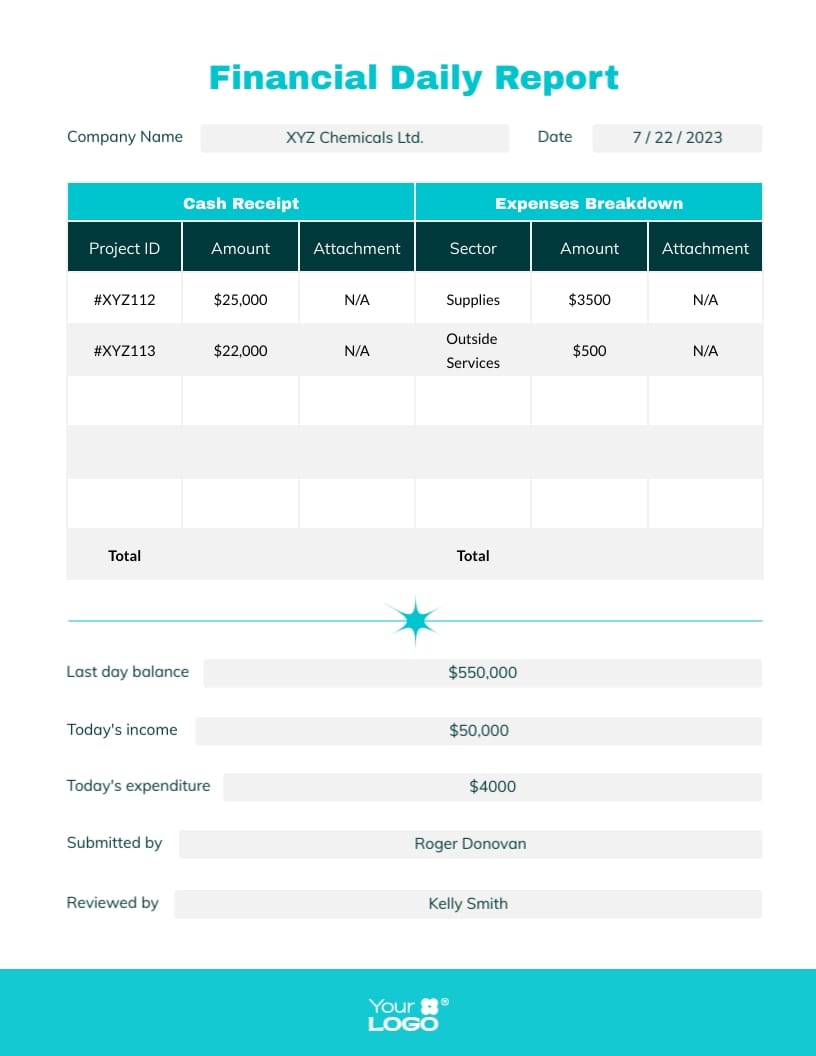

Examples of Financial Reports

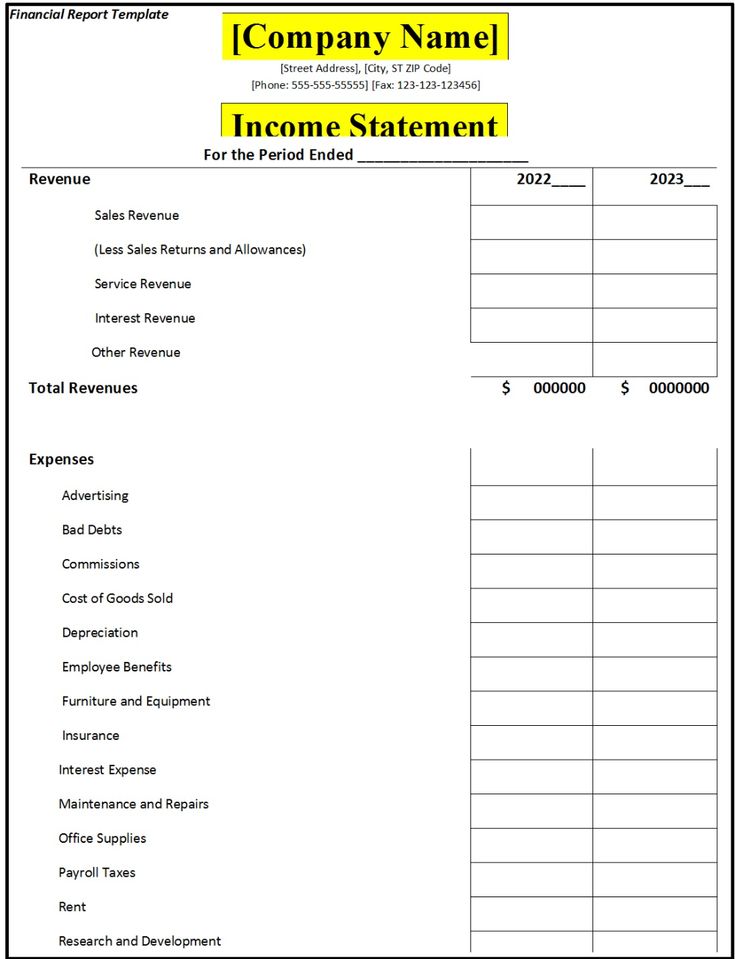

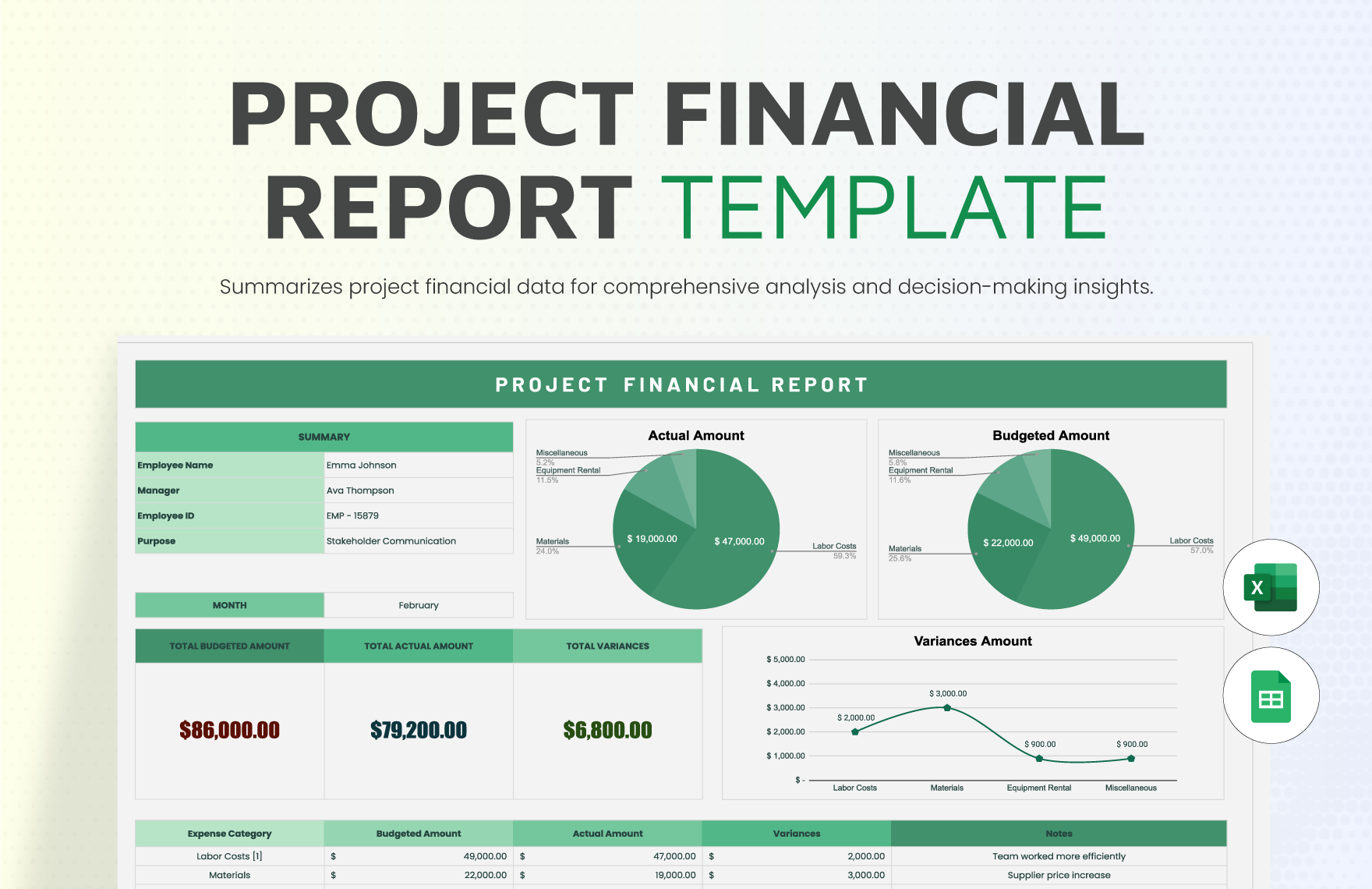

There are many different types of financial reports that you can create, depending on your specific financial goals and needs. Some common examples of financial reports include:

– Personal budget reports

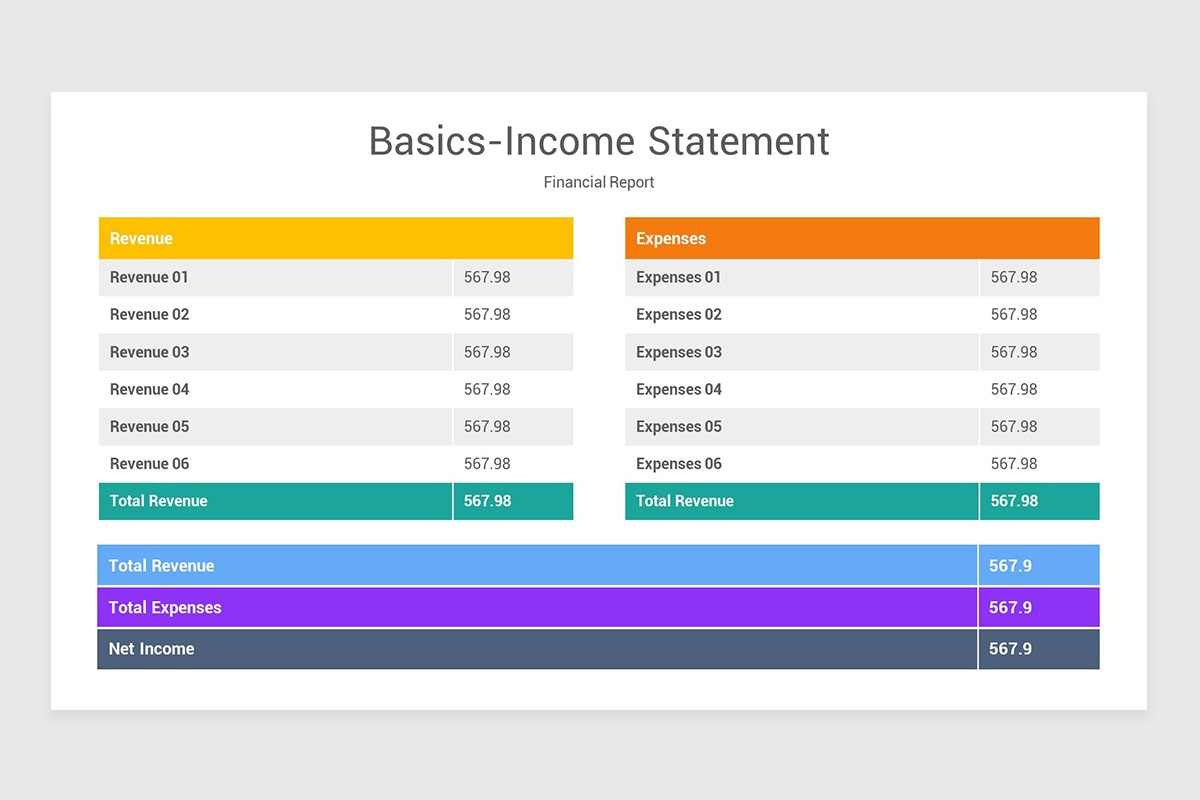

– Income statements

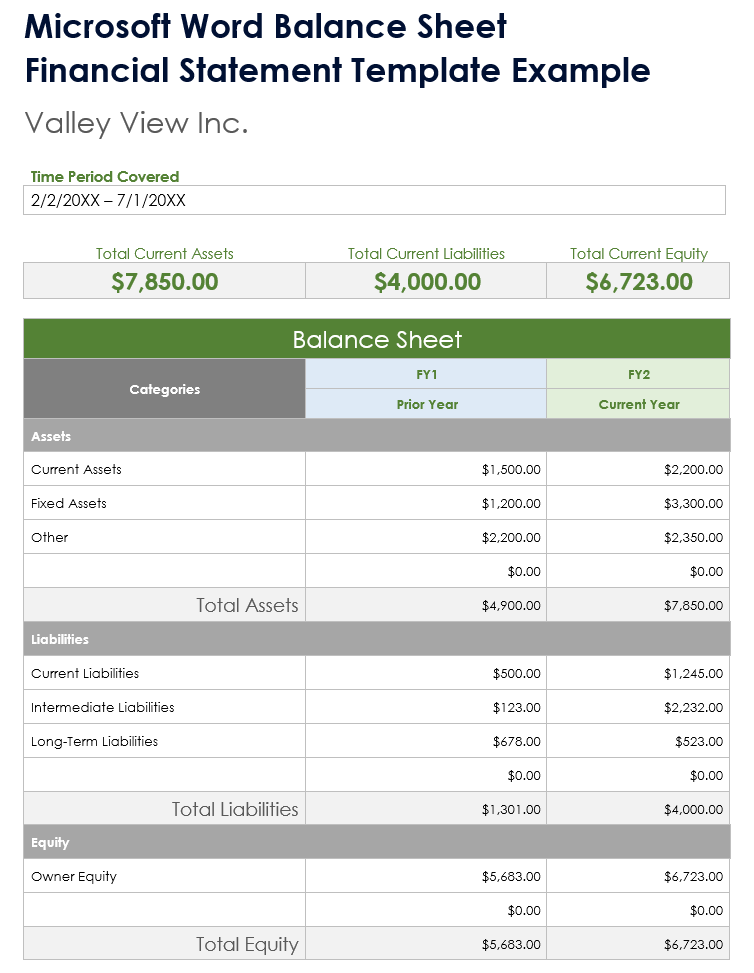

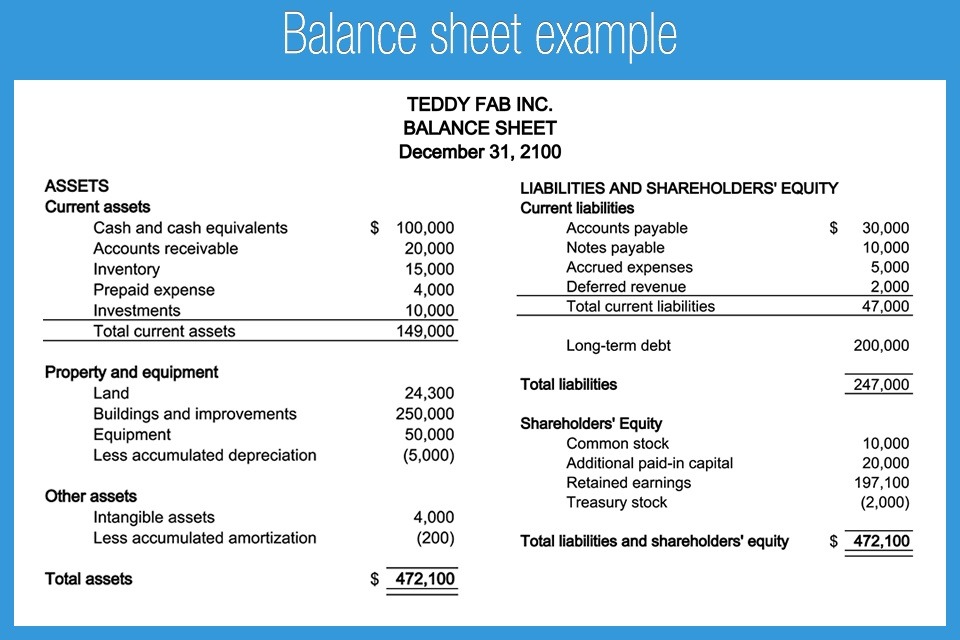

– Balance sheets

– Cash flow statements

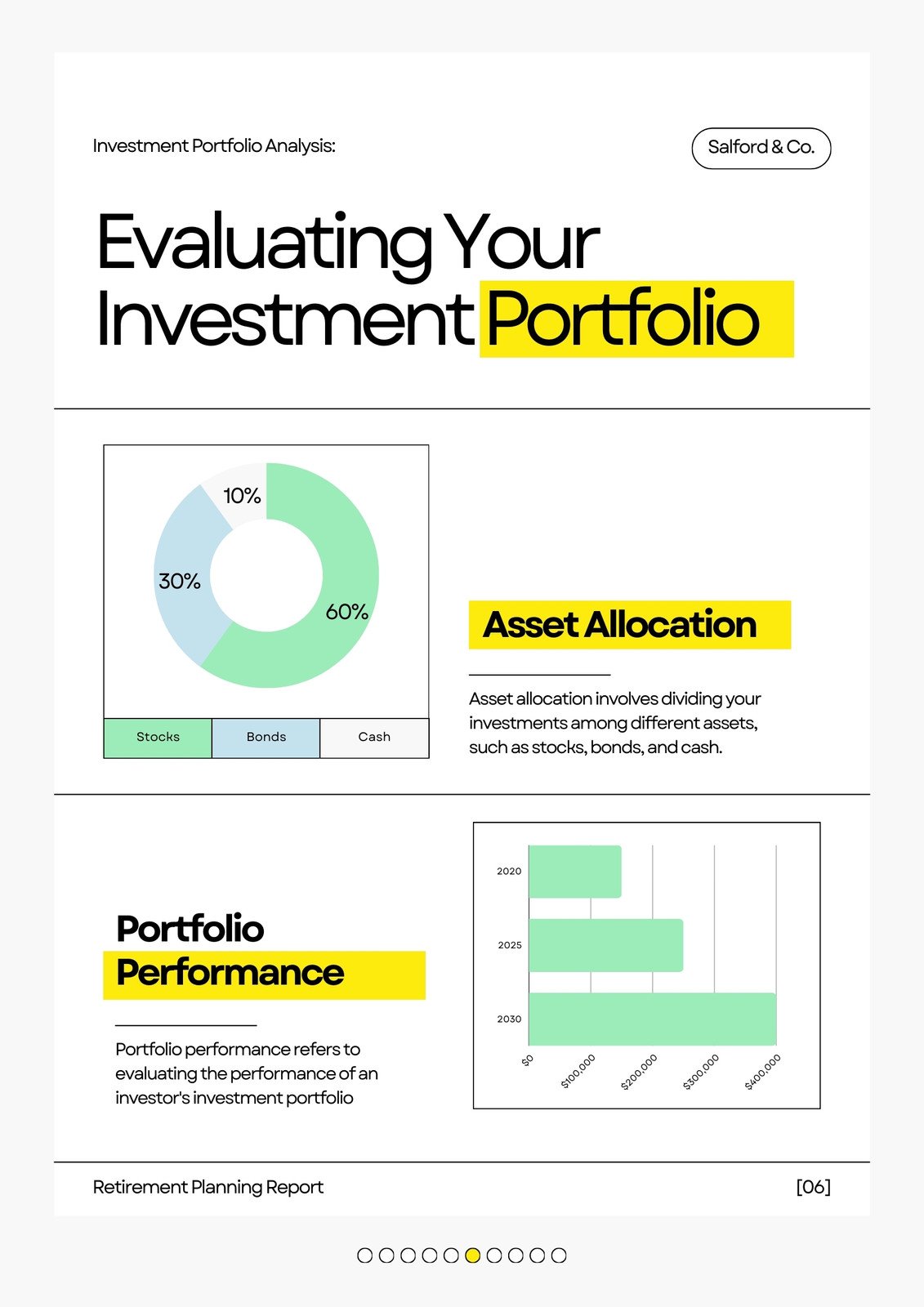

– Investment portfolio reports

Each of these reports provides valuable information about your financial situation and can help you make informed decisions about your money.

Tips for Successful Financial Reporting

To ensure that your financial reports are accurate and effective, consider the following tips:

– Keep detailed records of your financial transactions to ensure that your reports are accurate.

– Regularly review and update your financial reports to track your progress towards your financial goals.

– Use graphs and charts to visualize your financial data and make it easier to understand.

– Seek professional advice if you are unsure about how to create or interpret your financial reports.

– Be consistent in your reporting format to make it easier to compare data over time.

– Set specific financial goals and use your reports to track your progress towards achieving them.

By following these tips, you can create and maintain effective financial reports that provide valuable insights into your financial health.