Are you looking to take control of your finances and improve your financial health? One of the best tools to help you achieve this is a financial budget. A financial budget is a simple yet powerful tool that can help you track your income, expenses, savings, and investments.

In this comprehensive guide, we will explore what financial budgets are, why they are important, how to create one, examples of different types of budgets, and tips for successful budgeting.

What is a Financial Budget?

A financial budget is a document that outlines your income and expenses over a specific period, typically monthly. It helps you track where your money is coming from and where it is going, allowing you to make informed decisions about your finances.

By creating a budget, you can identify areas where you can save money, set financial goals, and track your progress towards achieving them.

Why Financial Budgets are Important

Creating and sticking to a budget is essential for achieving financial stability and security. Without a budget, it is easy to overspend, accumulate debt, and struggle to reach your financial goals.

A financial budget provides a clear picture of your financial situation, allowing you to make informed decisions about your spending and saving habits.

How to Create a Financial Budget

Creating a financial budget is easier than you might think. Follow these simple steps to get started:

- Gather Your Financial Information. Before you can create a budget, you need to gather all your financial information, including your income, expenses, debts, and savings.

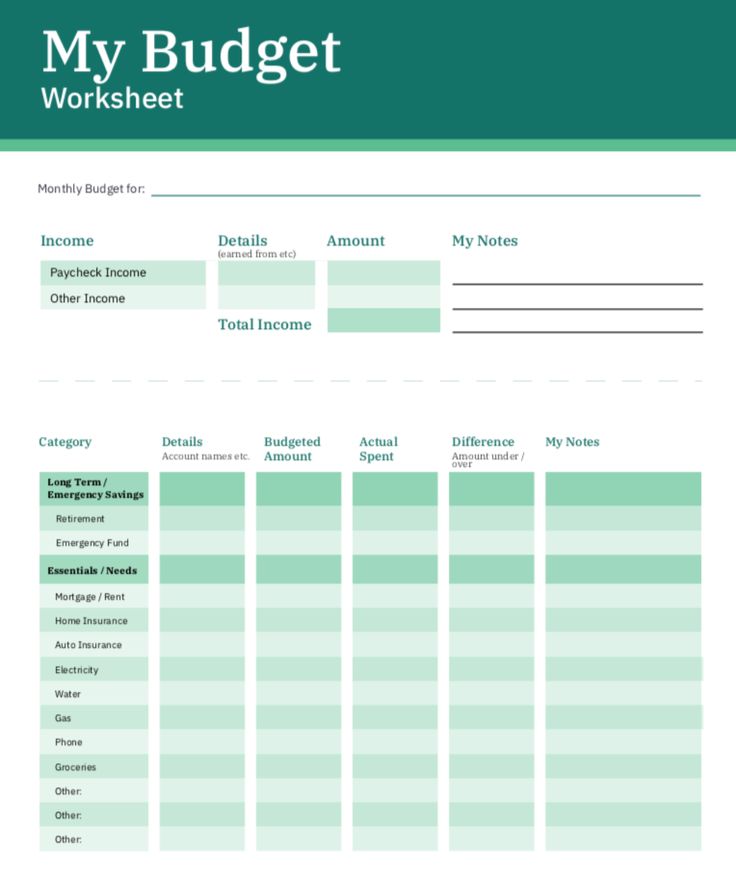

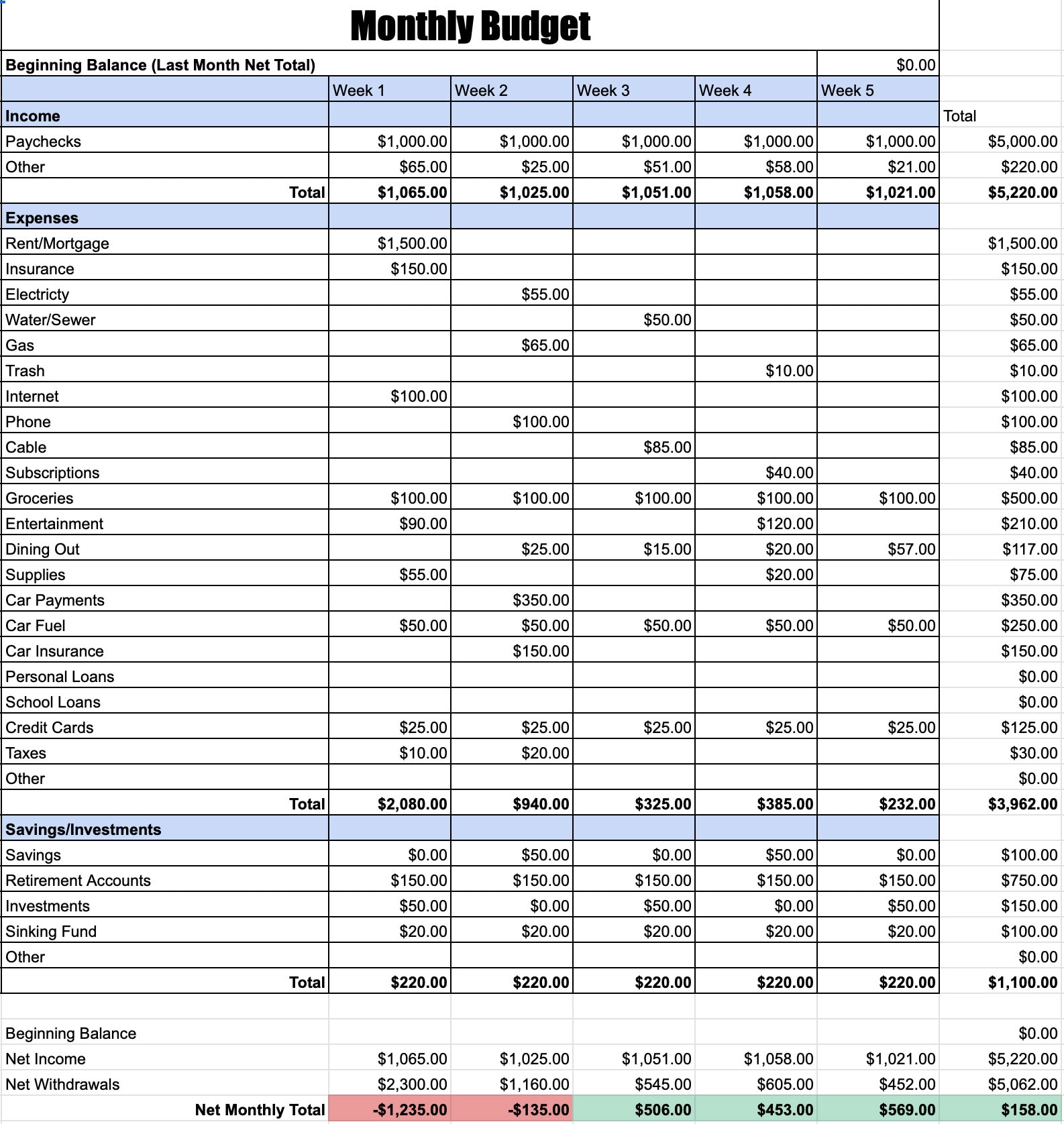

- Calculate Your Income. Determine how much money you earn each month from sources such as your salary, investments, and side hustles.

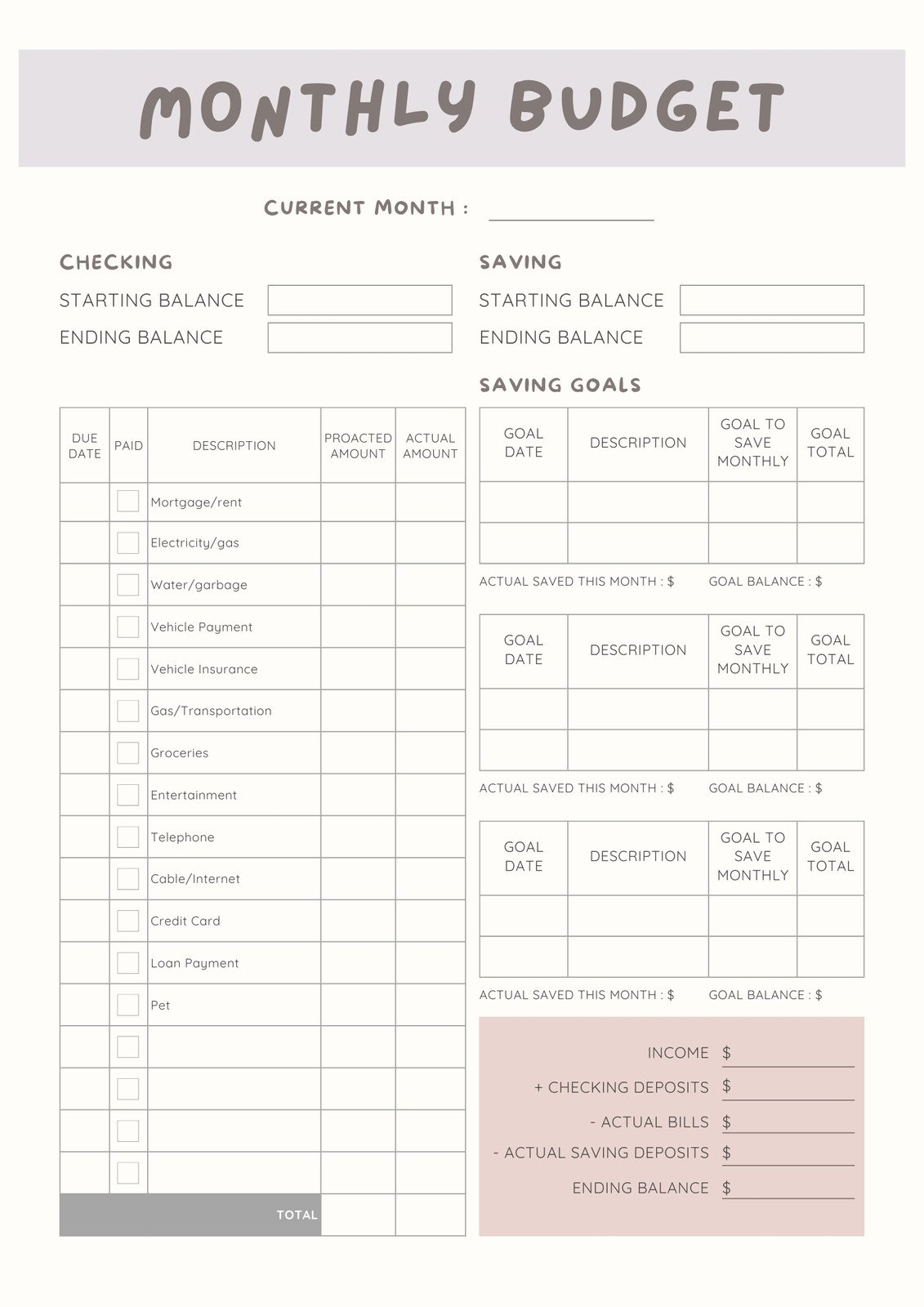

- List Your Expenses. Make a list of all your monthly expenses, including fixed costs like rent and utilities, as well as variable expenses like groceries and entertainment.

- Set Financial Goals. Identify your short-term and long-term financial goals, such as paying off debt, saving for a vacation, or buying a home.

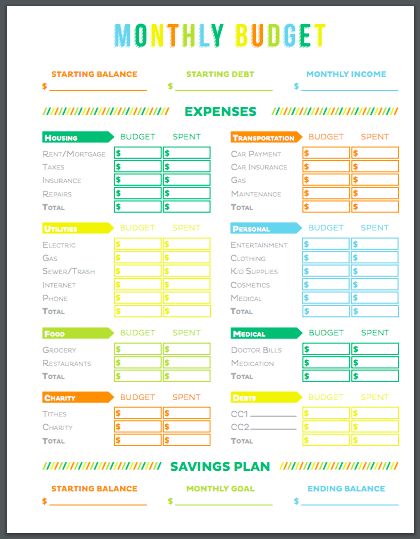

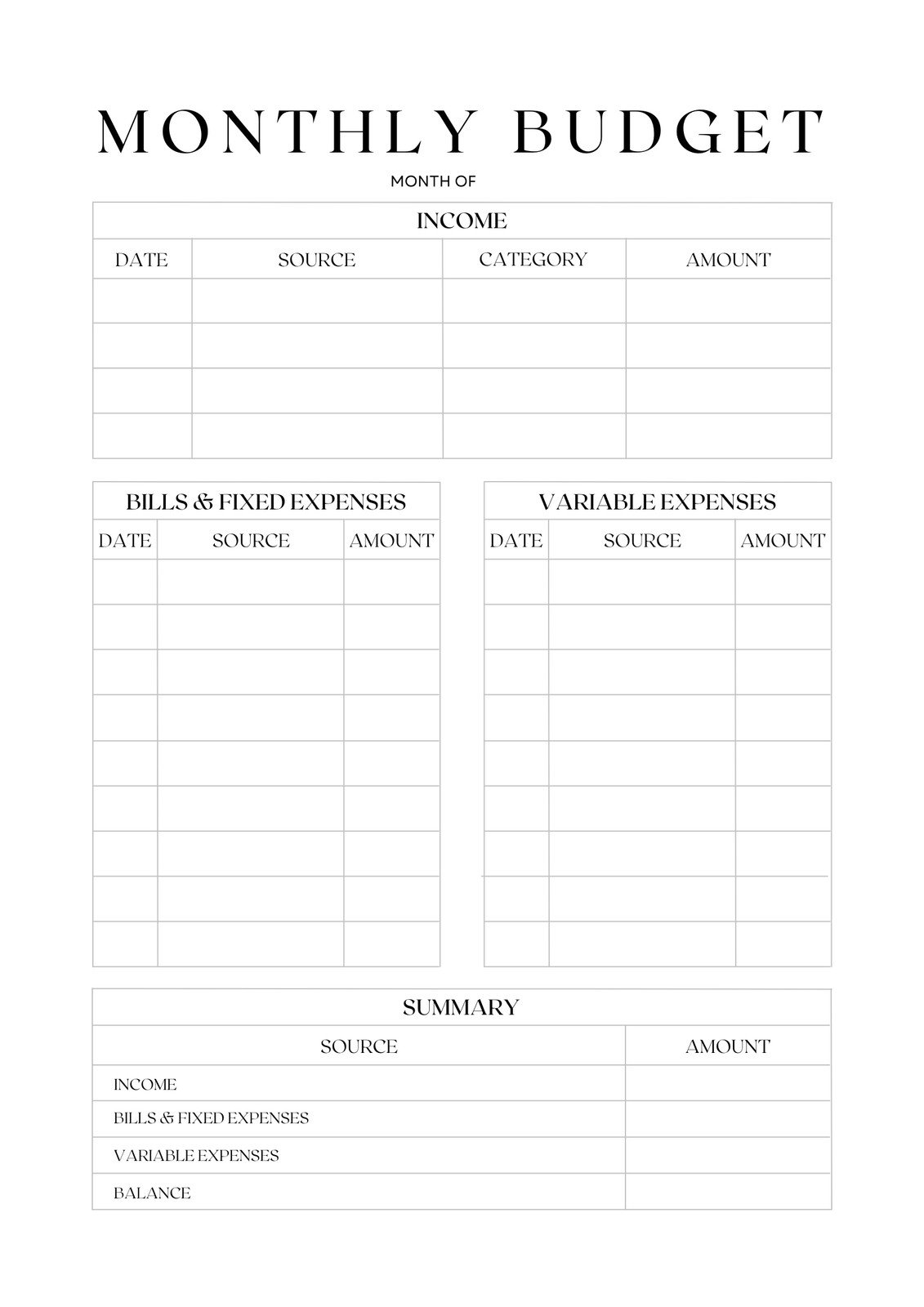

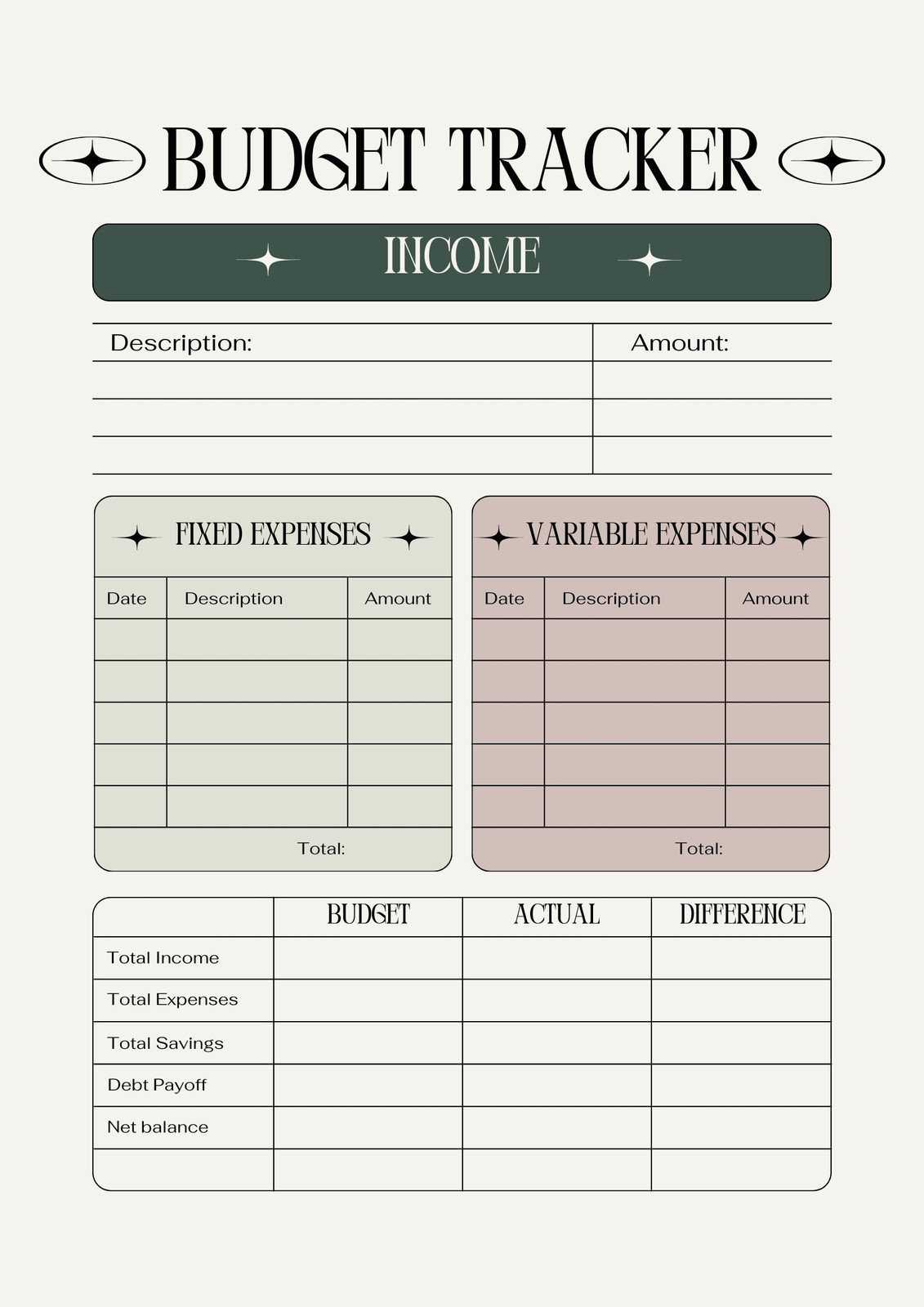

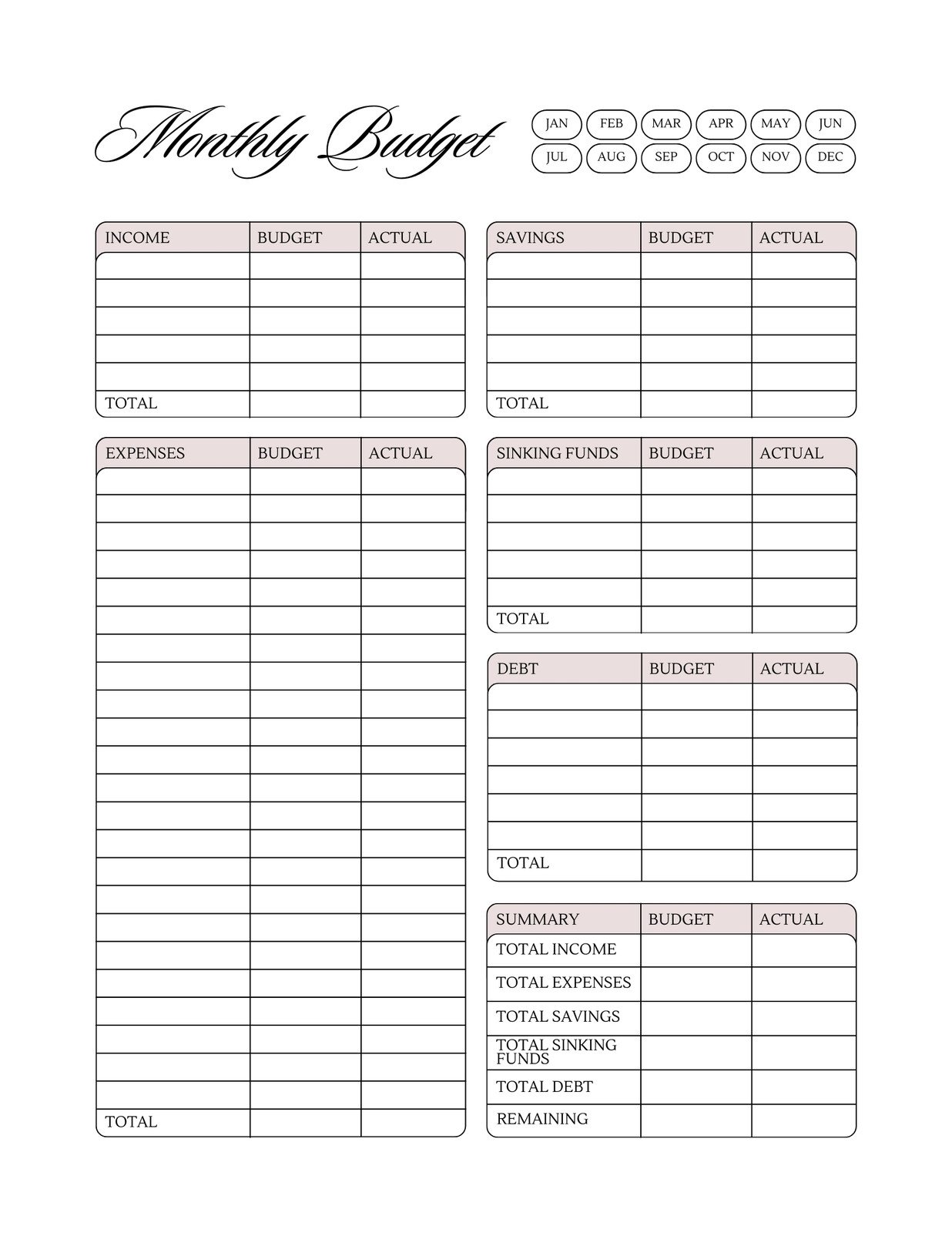

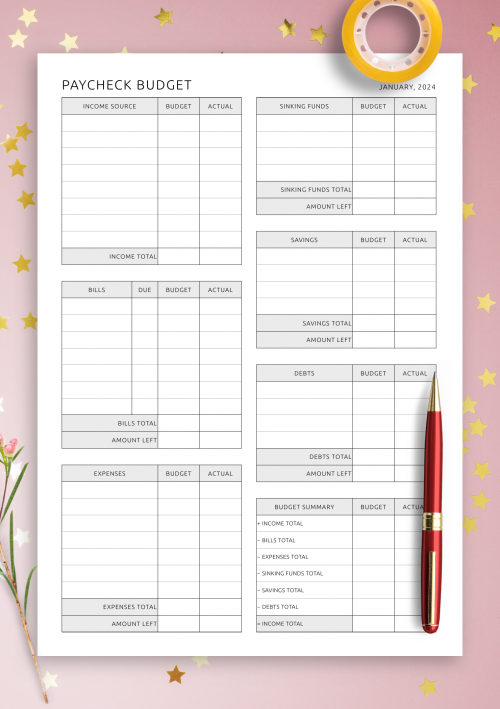

- Create Your Budget. Use a budget template or create your own spreadsheet to track your income, expenses, savings, and investments.

Examples of Financial Budgets

There are many different types of financial budgets to choose from, depending on your financial goals and preferences. Some common types of budgets include:

- Zero-Based Budget. Every dollar you earn is allocated to a specific category, leaving zero money unaccounted for.

- Envelope System. Cash is divided into envelopes for different spending categories to help you stick to your budget.

- Percentage-Based Budget. Allocate a percentage of your income to different categories, such as savings, housing, and transportation.

- Bi-Weekly Budget. Budgeting based on a bi-weekly pay schedule to better align with your income.

- Emergency Fund Budget. Focus on building up an emergency fund to cover unexpected expenses.

Tips for Successful Budgeting

Here are some tips to help you successfully create and stick to a financial budget:

- Track Your Spending. Keep track of every expense to ensure you are staying within your budget.

- Review Your Budget Regularly. Make adjustments as needed to reflect changes in your income or expenses.

- Automate Savings. Set up automatic transfers to your savings account to make saving easier.

- Avoid Impulse Purchases. Stick to your budget by avoiding unnecessary purchases.

- Reward Yourself. Celebrate reaching financial milestones to stay motivated.

By following these tips and creating a financial budget that works for you, you can take control of your finances and achieve your financial goals. Remember, budgeting is not about restricting yourself but about making informed decisions that will lead to a more secure financial future.