Performing a financial audit is a crucial process for any organization to ensure accuracy and compliance with regulations. To streamline this process, a financial audit checklist can be a valuable tool.

In this guide, we will explore what a financial audit checklist is, why it is important, how to create one, examples of items to include, and tips for a successful audit.

What is a Financial Audit Checklist?

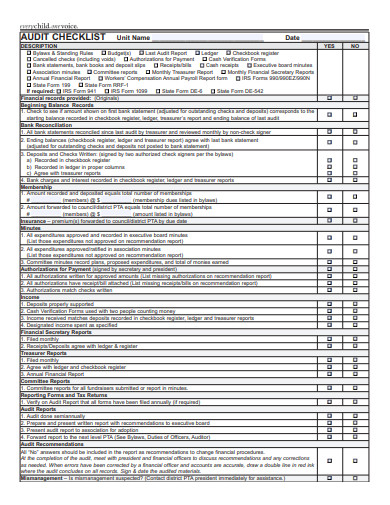

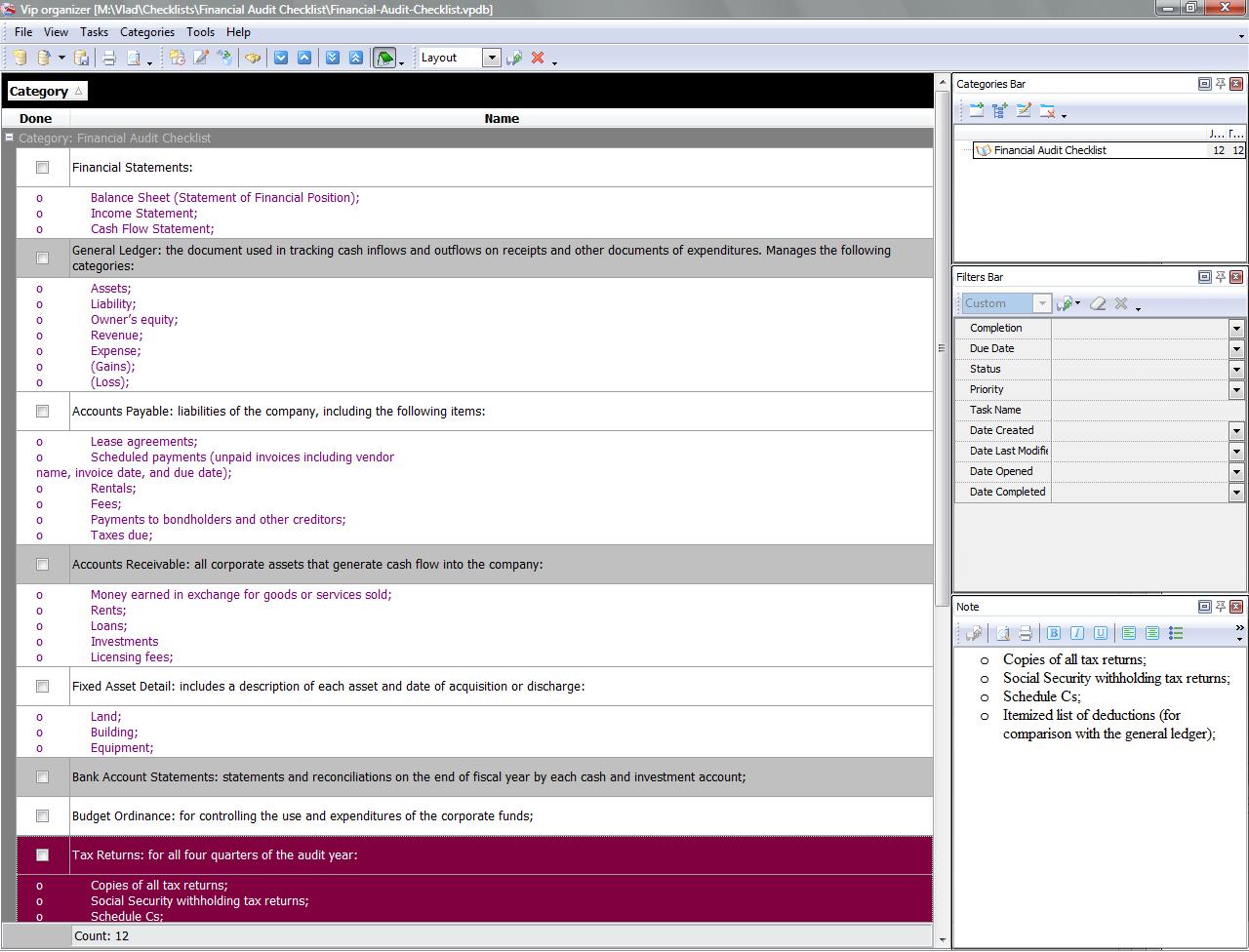

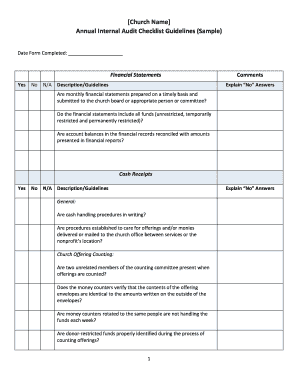

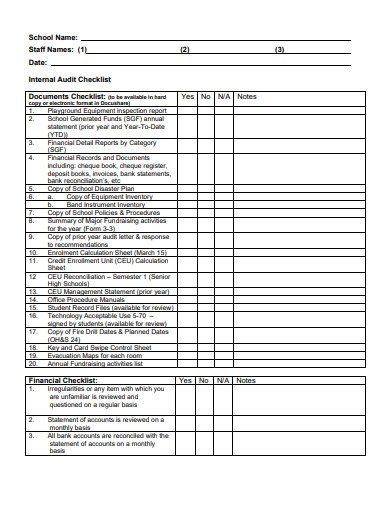

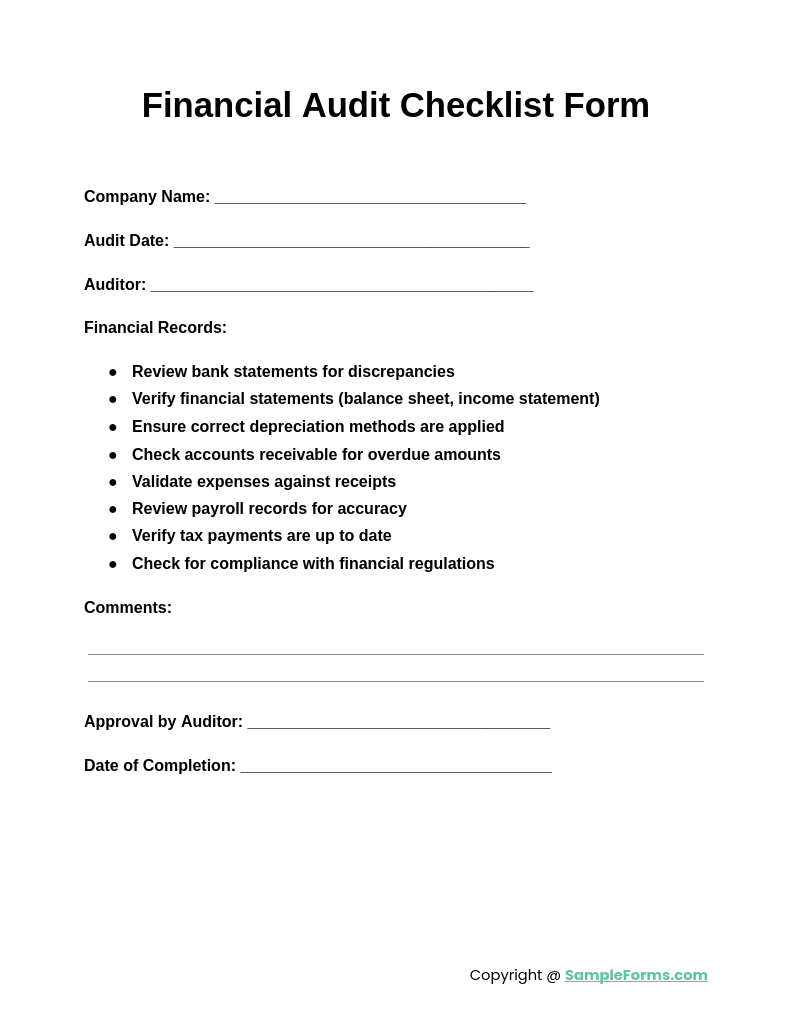

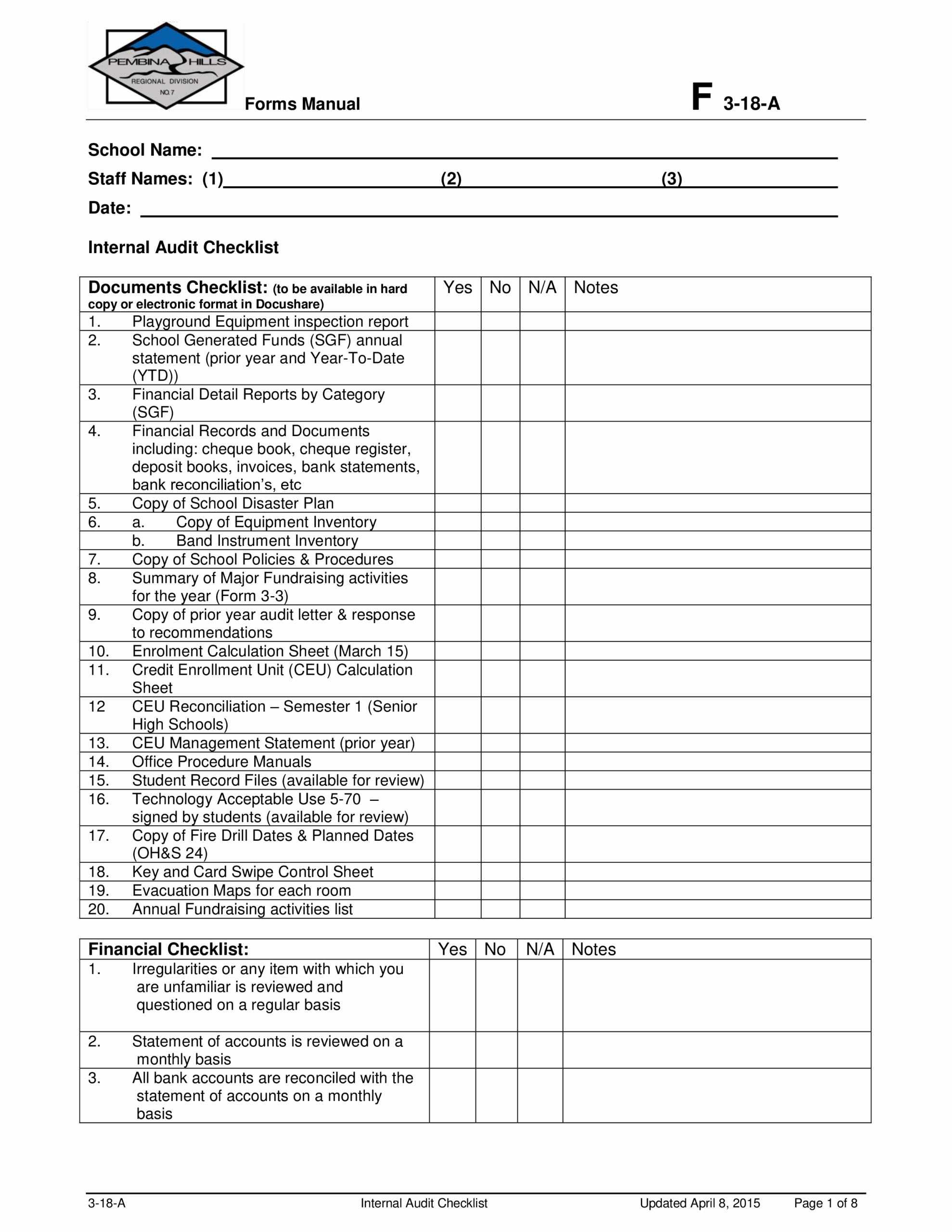

A financial audit checklist is a document that outlines the tasks and items that need to be reviewed during a financial audit. It serves as a roadmap for auditors to ensure that all necessary steps are taken and all relevant information is examined.

This checklist can be customized based on the specific needs and requirements of the organization undergoing the audit.

Why Use a Financial Audit Checklist?

Using a financial audit checklist offers several benefits.

- Firstly, it helps to ensure that the audit process is thorough and systematic, reducing the risk of overlooking critical areas.

- Additionally, it provides a standardized approach, making it easier to track progress and communicate findings to stakeholders.

- Lastly, a checklist can serve as a reference document for future audits, helping to maintain consistency and efficiency.

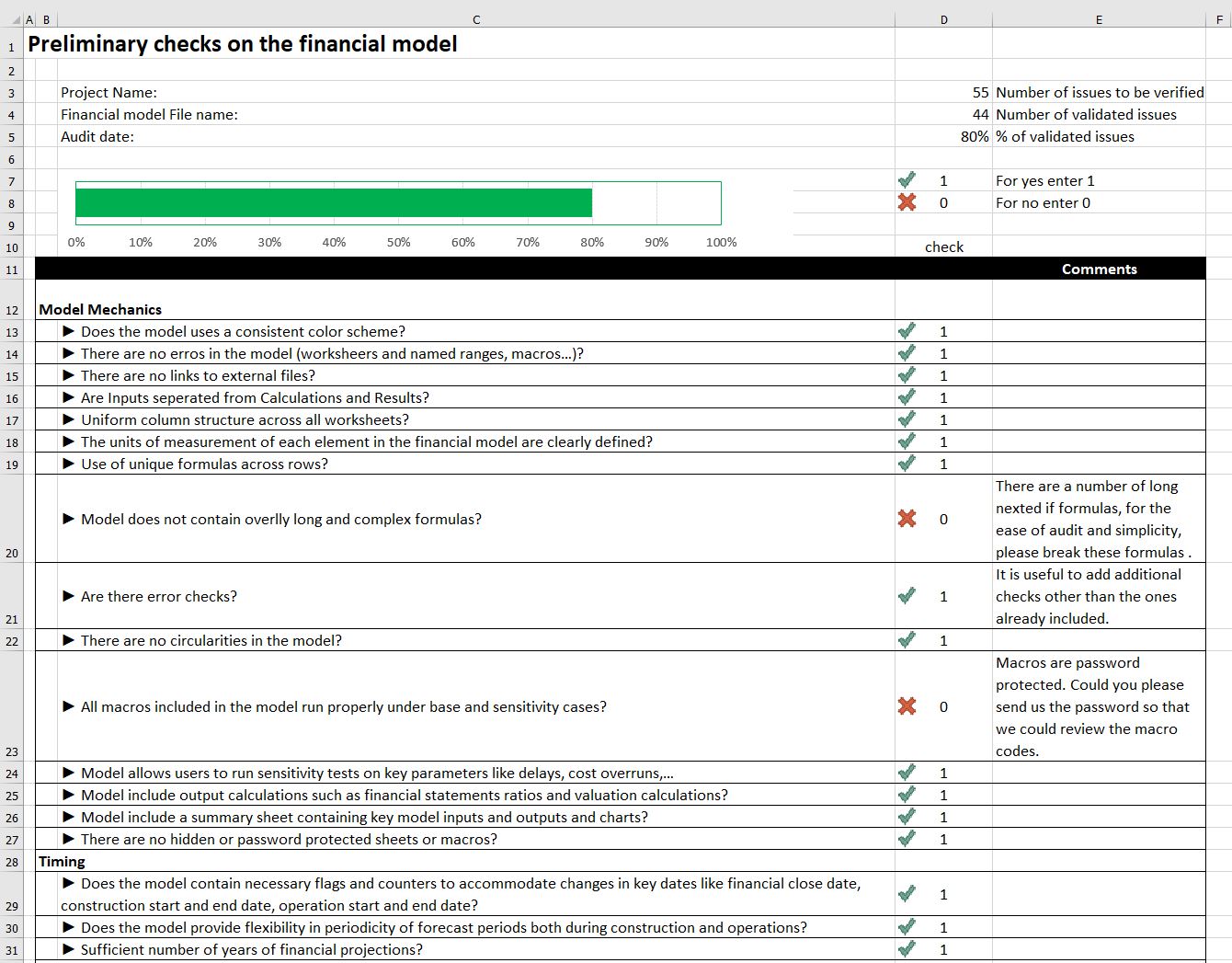

How to Create a Financial Audit Checklist

Creating a financial audit checklist involves several steps.

- Start by identifying the key areas that need to be reviewed, such as financial statements, internal controls, and compliance with regulations.

- Next, list out specific tasks or questions that need to be addressed within each area. Organize the checklist in a logical sequence to ensure a comprehensive review.

- Finally, review and refine the checklist to ensure it is clear, concise, and tailored to the organization’s needs.

Examples of Items to Include in a Financial Audit Checklist

When creating a financial audit checklist, consider including the following items:

- Financial Statements: Review balance sheets, income statements, and cash flow statements for accuracy and completeness.

- Internal Controls: Assess the effectiveness of internal controls to prevent fraud and errors.

- Compliance: Ensure compliance with relevant laws, regulations, and industry standards.

- Audit Trail: Verify the documentation and trail of transactions for transparency and accountability.

- Risk Assessment: Identify potential risks and vulnerabilities that may impact the organization’s financial health.

Tips for Successful Financial Audits

Here are some tips to ensure a successful financial audit:

- Plan Ahead: Establish a timeline and allocate resources for the audit process.

- Communicate Effectively: Keep stakeholders informed and address any concerns or questions promptly.

- Stay Organized: Maintain detailed documentation and records throughout the audit.

- Collaborate with Auditors: Work closely with auditors to provide access to information and address any issues that arise.

- Follow Up: Implement recommendations and corrective actions identified during the audit to improve financial processes.

By utilizing a financial audit checklist and following best practices, organizations can ensure a thorough and effective financial audit process. Remember, preparation and attention to detail are key to a successful audit.