In the world of accounting, a general ledger is a crucial tool for keeping track of a company’s financial transactions. It serves as the backbone of the accounting system, providing a detailed record of all financial activities.

A general ledger typically includes accounts for assets, liabilities, equity, revenue, and expenses. While traditional general ledgers were maintained manually in physical books, modern technology has made it easier to create and manage digital versions, including general ledgers.

What is a General Ledger?

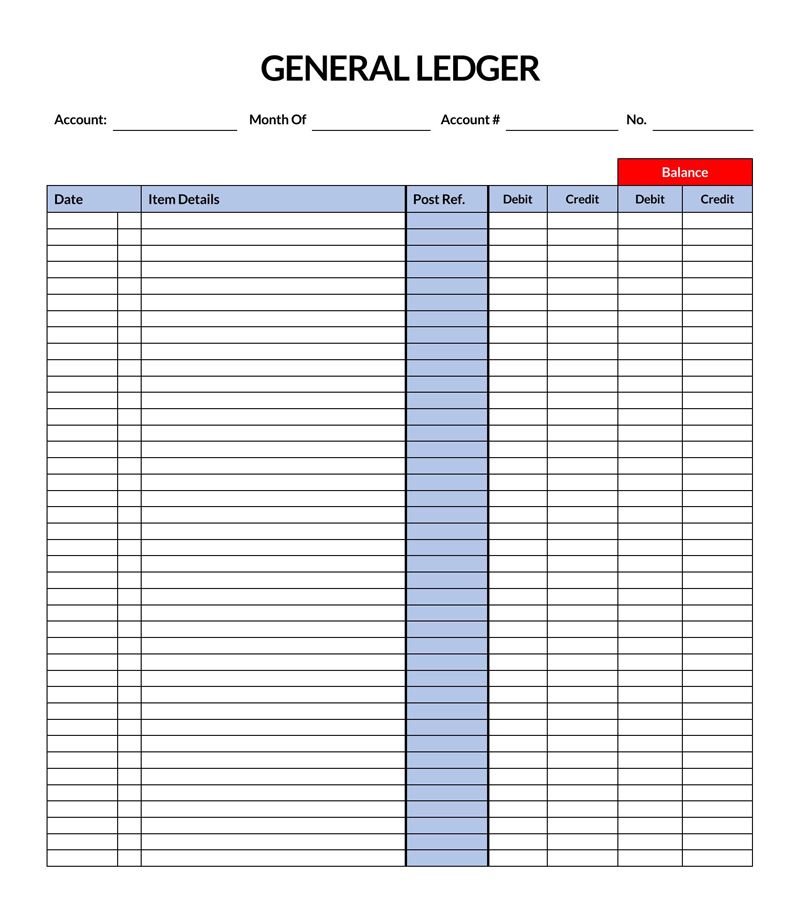

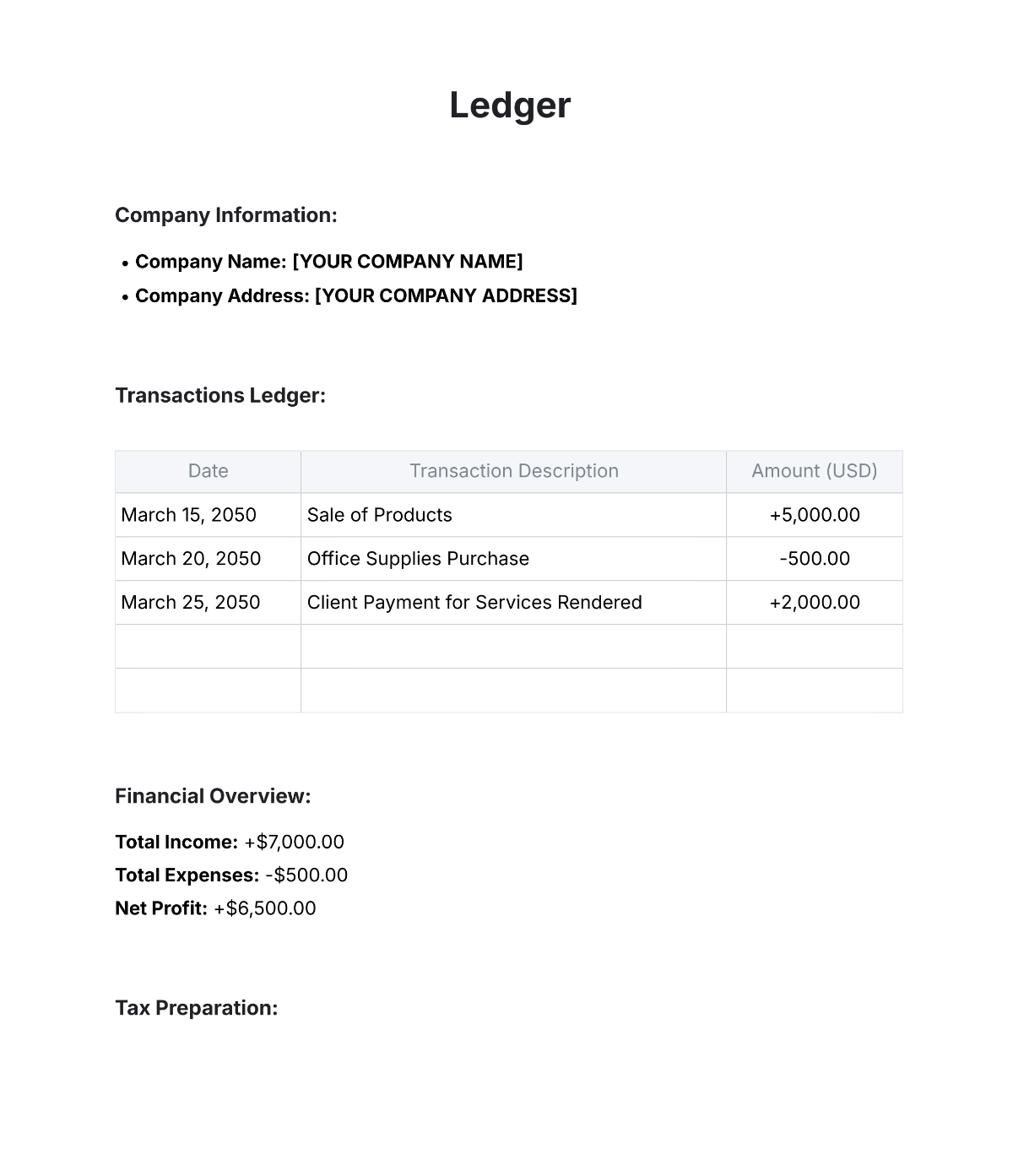

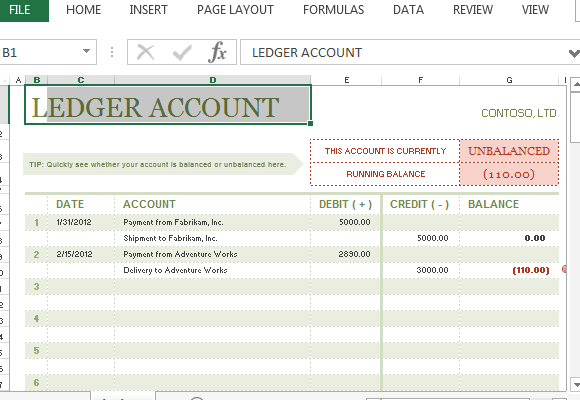

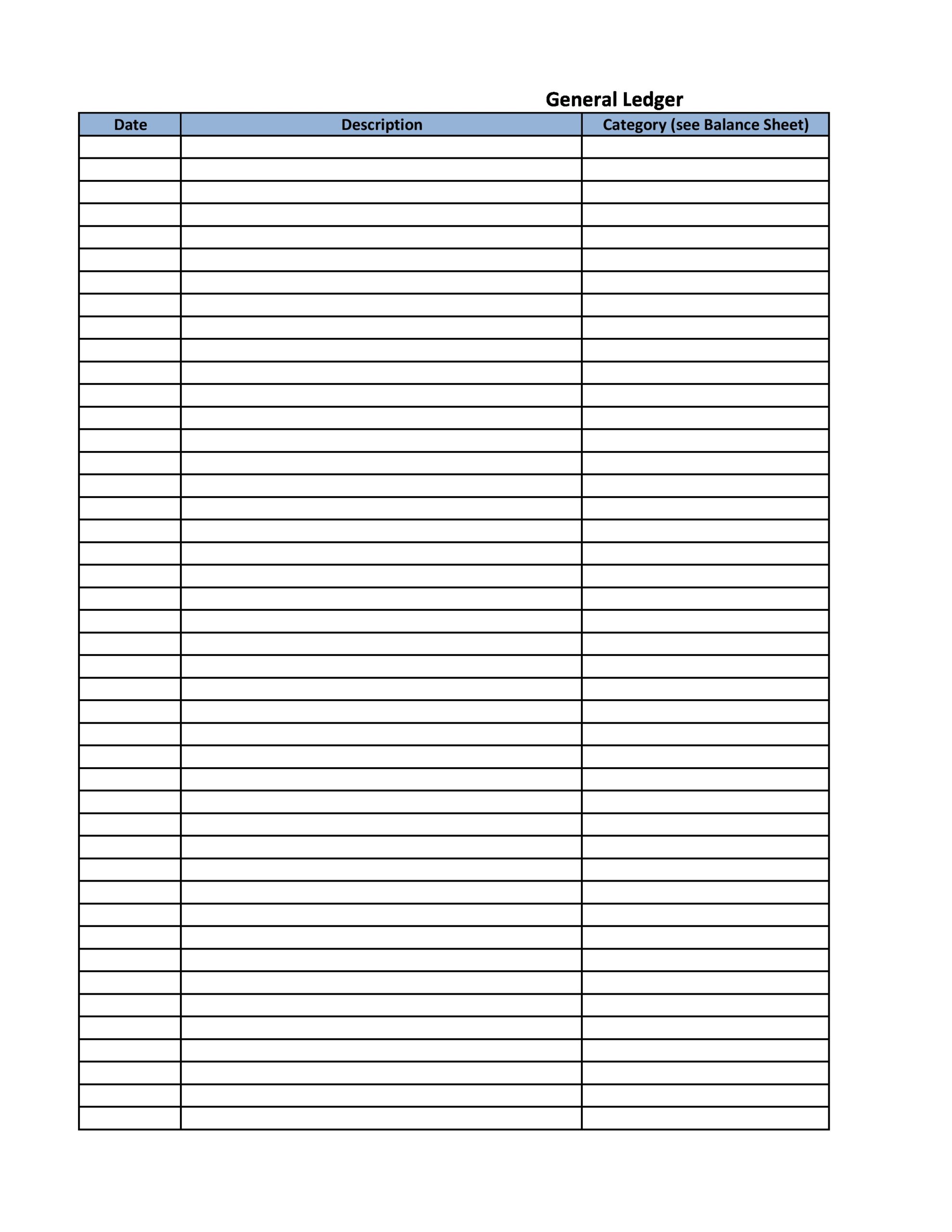

A general ledger is a digital document that mirrors the format of a traditional general ledger but can be easily printed out for reference or record-keeping purposes. It contains all the essential elements of a standard general ledger, such as account names, transaction details, and balances.

General ledgers are commonly used by small businesses, freelancers, and individuals to track their financial transactions without the need for expensive accounting software.

Benefits of Using a General Ledger

There are several advantages to using a general ledger, including:

- Cost-effective: general ledgers are typically free or low-cost compared to accounting software.

- Easy to use: You don’t need to be an accounting expert to understand and maintain a general ledger.

- Customizable: You can tailor the layout and categories of your general ledger to suit your specific needs.

- Accessible: general ledgers can be easily printed out or saved in digital format for quick reference.

How to Create a General Ledger

Creating a general ledger is a straightforward process that involves setting up columns for account names, transaction details, and balances. You can use a spreadsheet program like Microsoft Excel or Google Sheets to design your general ledger template.

Start by listing out your accounts and their corresponding balances, then input your transaction details as they occur. Be sure to update your general ledger regularly to maintain accurate financial records.

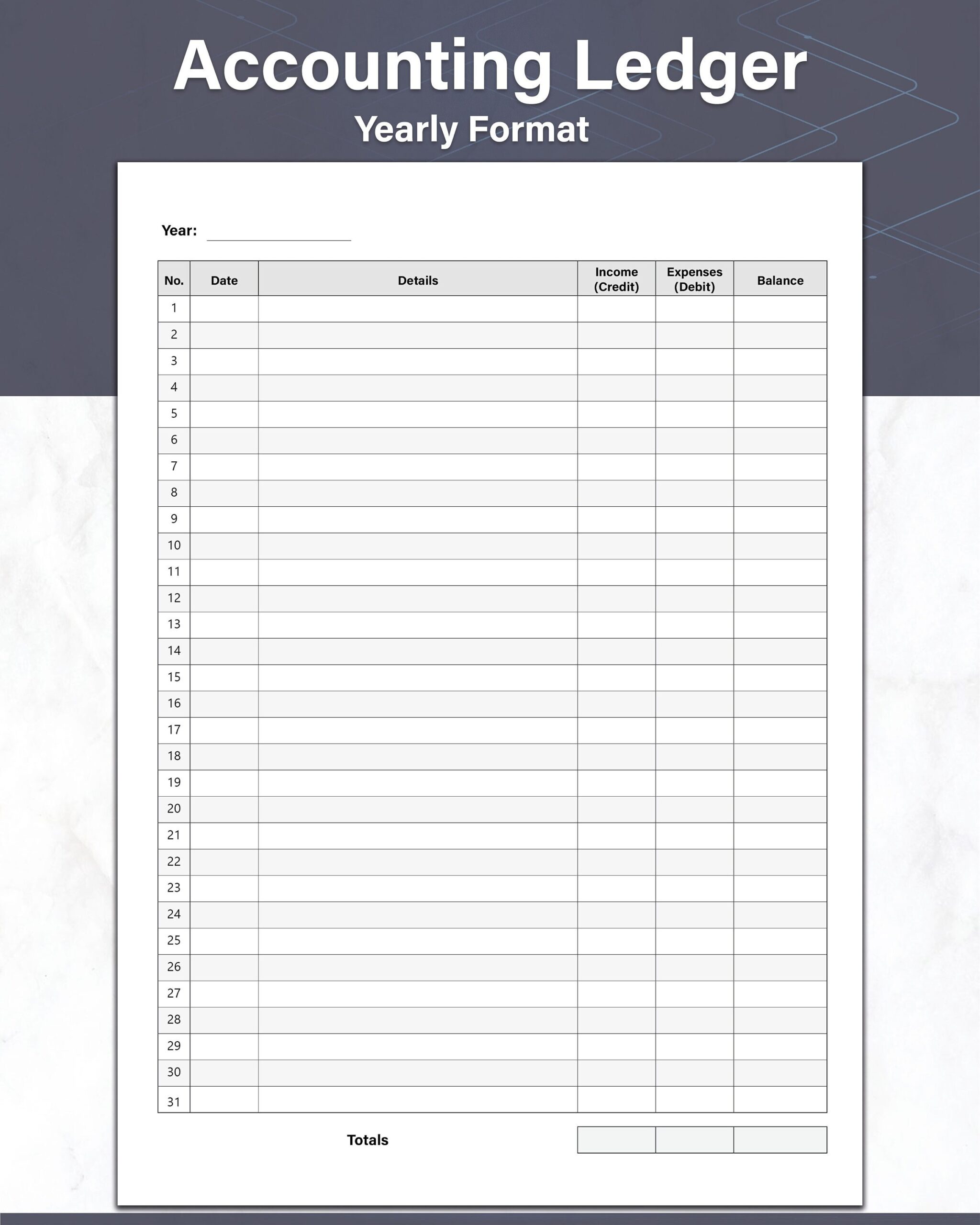

Examples of General Ledger Templates

There are countless general ledger templates available online for free or for purchase. Some popular examples include:

Tips for Successful General Ledger Management

Here are some tips to help you effectively manage your general ledger:

- Regular Updates: Make it a habit to update your general ledger daily or weekly to ensure accuracy.

- Backup Your Data: Save digital copies of your general ledger in case of loss or damage.

- Review Periodically: Take time to review your general ledger periodically to identify any discrepancies or errors.

Conclusion

In conclusion, a general ledger is a valuable tool for anyone looking to maintain organized and accurate financial records. Whether you’re a business owner, freelancer, or individual, using a general ledger can help you track your income, expenses, and overall financial health. By following the tips outlined in this guide and regularly updating your general ledger, you can stay on top of your finances and make informed decisions about your money.